Business Interruption Insurance – Terminology Explained

Click Here For More Information On Business Insurance With S.A. Faughnan

What is Business interruption?

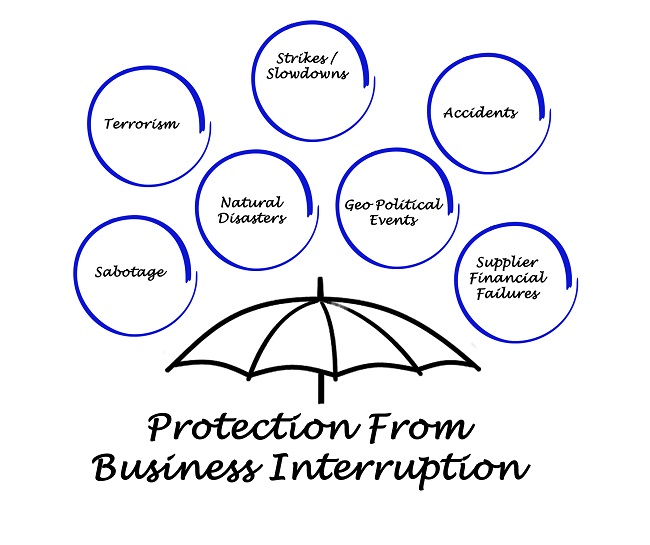

Business interruption insurance (also known as business income insurance or consequential loss insurance) is a type of insurance that covers the loss of income that a business suffers after a disaster. The income loss covered may be due to disaster-related closing of the business facility or due to the rebuilding process after a disaster. This insurance cover is designed to put a business in the same financial position it would have been in if no loss had occurred.

Common terminology to describe the methods of calculation referred to within this insurance cover

- Working Expenses

Raw Materials and other direct production costs, sometimes called variables, are referred to as Working Expenses. These are costs which vary in direct proportion to the Sales, e.g. purchases (less discounts received) packing, carriage, discounts allowed and bad debts.

- Standing Charges

Charges, sometimes called Fixed Charges, or overheads, are referred to as Standing Charges. These are costs which do not vary in direct proportion to the Sales. Some are fixed, e.g. Business Rates. Others are variable e.g. heating, phones etc.

- Net Profit

Net profit, sometimes called a margin, is the surplus left after paying all the costs and charges i.e. Working Expenses and Standing Charges.

- Turnover

Sales, or Revenue, or Income, or Earnings, or Fees are all referred to as Turnover.

- Gross Profit

Gross Profit is defined as the difference between Turnover and Working Expenses.

- Rate of Gross Profit

Rate of Gross Profit is normally expressed as a percentage of Turnover.

Remember: Business Interruption Insurance differs from property insurance in that a property insurance policy only covers the physical damage to the business, while the additional coverage provided by the business interruption policy covers the profits that would have been earned.

Click Here For More Information On Business Insurance With S.A. Faughnan